Rewarding

Simple solutions quickly available at your fingertips. Apply with just one document

Simple solutions quickly available at your fingertips. Apply with just one document

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

Send in your loan application using our app by filling out a quick form.

Stand by for our decision, usually delivered in just 15 minutes.

Secure your funds, generally processed in just one minute.

Send in your loan application using our app by filling out a quick form.

Download loan app

When financial emergencies strike, having access to quick and reliable loans can make all the difference. In South Africa, mini loans in minutes have become a popular option for those in need of fast cash. These loans offer a range of benefits that make them a convenient and efficient way to meet short-term financial needs.

One of the key advantages of mini loans in minutes is the speed at which they are approved. In most cases, borrowers can apply for a loan online and receive approval within minutes. This means that you can access the funds you need quickly, without having to wait days or weeks for approval.

This streamlined process ensures that you can get the money you need when you need it most, whether you are facing unexpected medical bills, car repairs, or other financial emergencies.

Mini loans in minutes typically offer borrowers the flexibility to choose loan amounts that suit their individual needs. Whether you need a small amount of cash to cover a minor expense or a larger sum to address a more significant financial obligation, mini loans can be tailored to your specific requirements.

With loan amounts ranging from a few hundred to a few thousand rand, borrowers can select the exact amount they need without taking on unnecessary debt.

Unlike traditional bank loans that often require collateral, mini loans in minutes are typically unsecured. This means that borrowers do not have to put up valuable assets, such as a car or home, to secure the loan. Instead, qualification is usually based on factors such as income and credit history.

This makes mini loans a viable option for individuals who do not own property or who are reluctant to risk their assets in exchange for a loan.

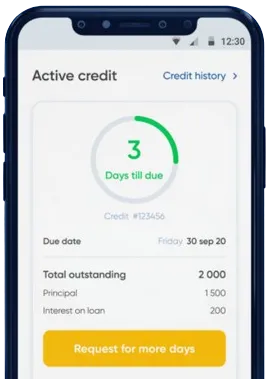

Mini loans in minutes often come with flexible repayment terms that can be customized to suit your financial situation. Whether you prefer to make weekly, bi-weekly, or monthly payments, lenders can work with you to create a repayment plan that fits your budget.

Additionally, many lenders offer online account management tools that allow you to track your loan balance, make payments, and monitor your repayment schedule with ease.

Mini loans in minutes provide a quick and convenient solution for those facing unexpected expenses or short-term financial challenges in South Africa. With rapid approval processes, flexible loan amounts, no collateral requirements, and convenient repayment options, these loans offer a range of benefits that make them a valuable resource for individuals in need of fast cash.

Mini loans in minutes are small, short-term loans that are typically processed and approved quickly, often within a matter of minutes. They are designed to provide borrowers with fast access to cash when they need it urgently.

Eligibility requirements for mini loans in minutes vary among lenders, but generally, applicants must be South African citizens or residents, have a valid ID, be employed, and have a bank account. Some lenders may also require a minimum income level or credit score.

The amount you can borrow with a mini loan in minutes in South Africa typically ranges from R500 to R5000, depending on the lender. However, first-time borrowers may be limited to a lower amount until they establish a repayment history with the lender.

Repayment periods for mini loans in minutes in South Africa are usually short, ranging from a few days to a few weeks. Some lenders may offer flexible repayment options, allowing borrowers to choose their repayment schedule.

Once your mini loan application is approved, funds are typically disbursed within minutes or hours, depending on the lender's processing times. Some lenders may offer same-day or next-day funding to provide borrowers with fast access to cash.

Interest rates for mini loans in minutes in South Africa can be higher than traditional loans due to their short-term nature and quick approval process. It is important to carefully review the terms and conditions of the loan agreement to understand the total cost of borrowing.